Coca-Cola Europacific Partners reports share repurchases across multiple markets

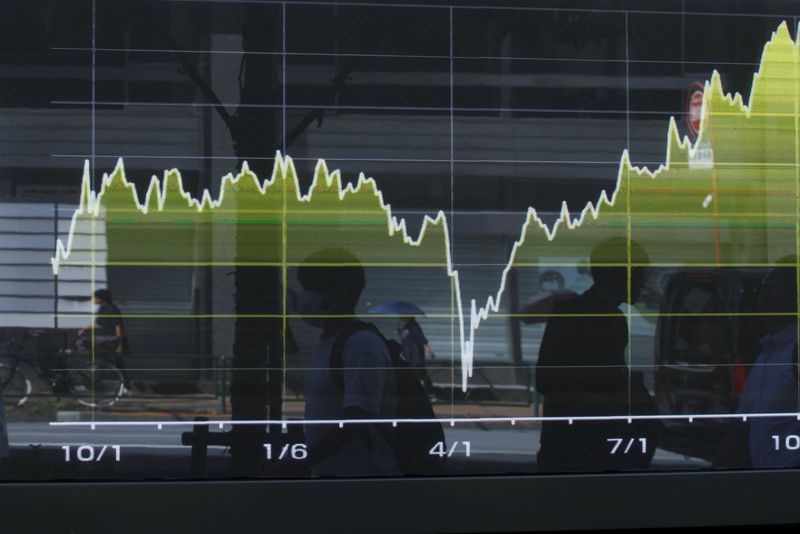

PositiveFinancial Markets

Coca-Cola Europacific Partners has announced a series of share repurchases across various markets, signaling confidence in its financial health and commitment to returning value to shareholders. This move is significant as it reflects the company's strong performance and strategic focus, which can boost investor confidence and potentially enhance stock prices.

— Curated by the World Pulse Now AI Editorial System