Stock Market Today: Nvidia Rallies 5% On $500 Billion Booking Projection, Lifting Nasdaq and S&P 500 to Fresh Records

PositiveFinancial Markets

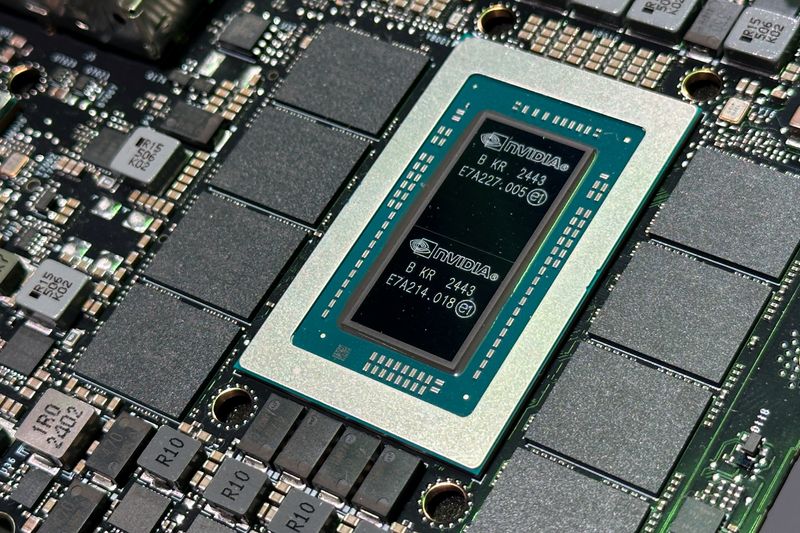

Today, Nvidia's stock surged by 5% following a remarkable $500 billion booking projection, which has propelled both the Nasdaq and S&P 500 to new record highs. This significant uptick not only reflects investor confidence in Nvidia's future but also signals a broader positive trend in the stock market, making it an exciting time for investors and analysts alike.

— Curated by the World Pulse Now AI Editorial System