Yen Traders Caught in ‘Mass Square-Up’ Following Takaichi Win

NeutralFinancial Markets

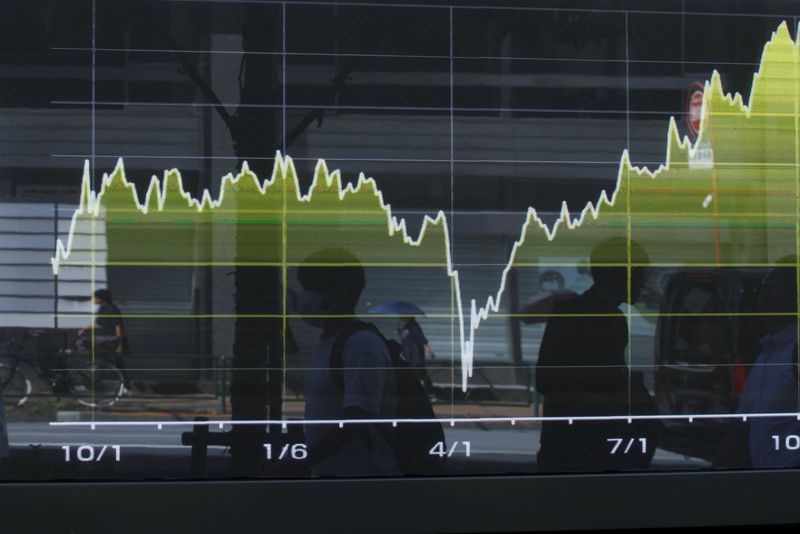

Yen traders experienced significant activity on Monday as macro hedge funds engaged in a process known as 'squaring up' following Takaichi's win. This involved closing out bullish positions rather than taking new bearish ones, indicating a shift in strategy among traders. Understanding these movements is crucial as they can influence currency markets and investor sentiment.

— Curated by the World Pulse Now AI Editorial System