Central banks will end up holding Bitcoin in their reserves even though it is ‘backed by nothing,’ Deutsche Bank predicts

PositiveFinancial Markets

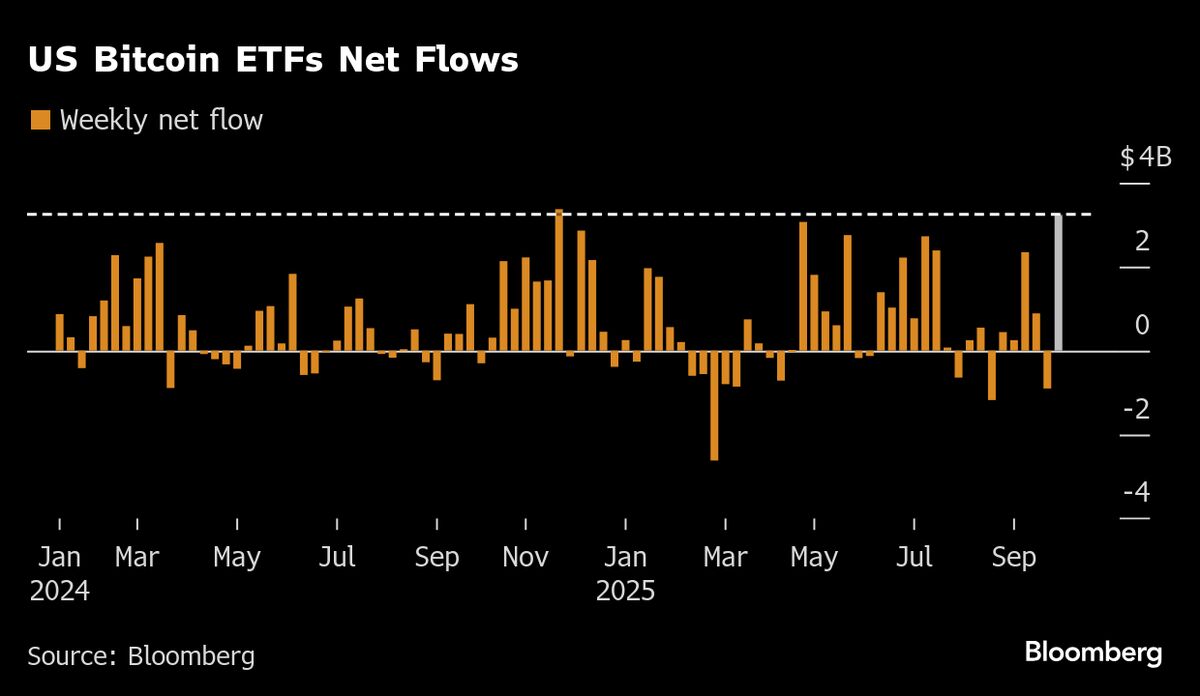

Deutsche Bank's latest analysis suggests that as Bitcoin's price continues to rise, its volatility is decreasing, making it more comparable to gold. This shift could lead central banks to consider holding Bitcoin in their reserves, despite its lack of traditional backing. This is significant because it indicates a growing acceptance of cryptocurrencies in mainstream finance, potentially reshaping how we view digital assets and their role in the economy.

— Curated by the World Pulse Now AI Editorial System