Nvidia’s New Product Merges AI Supercomputing with Quantum

PositiveFinancial Markets

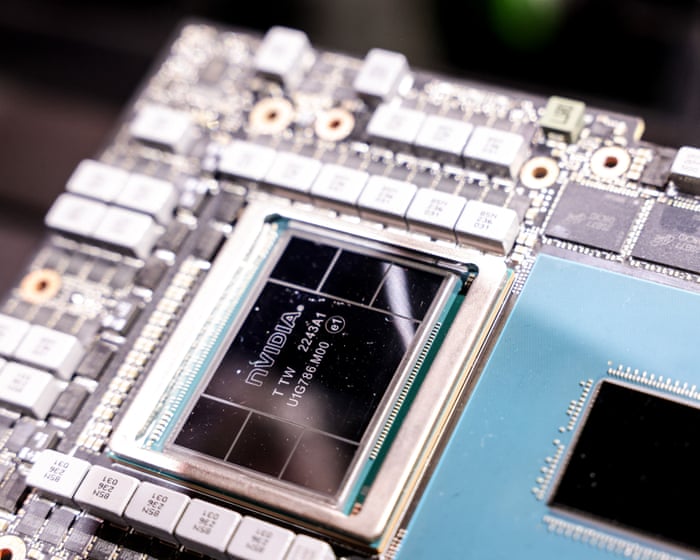

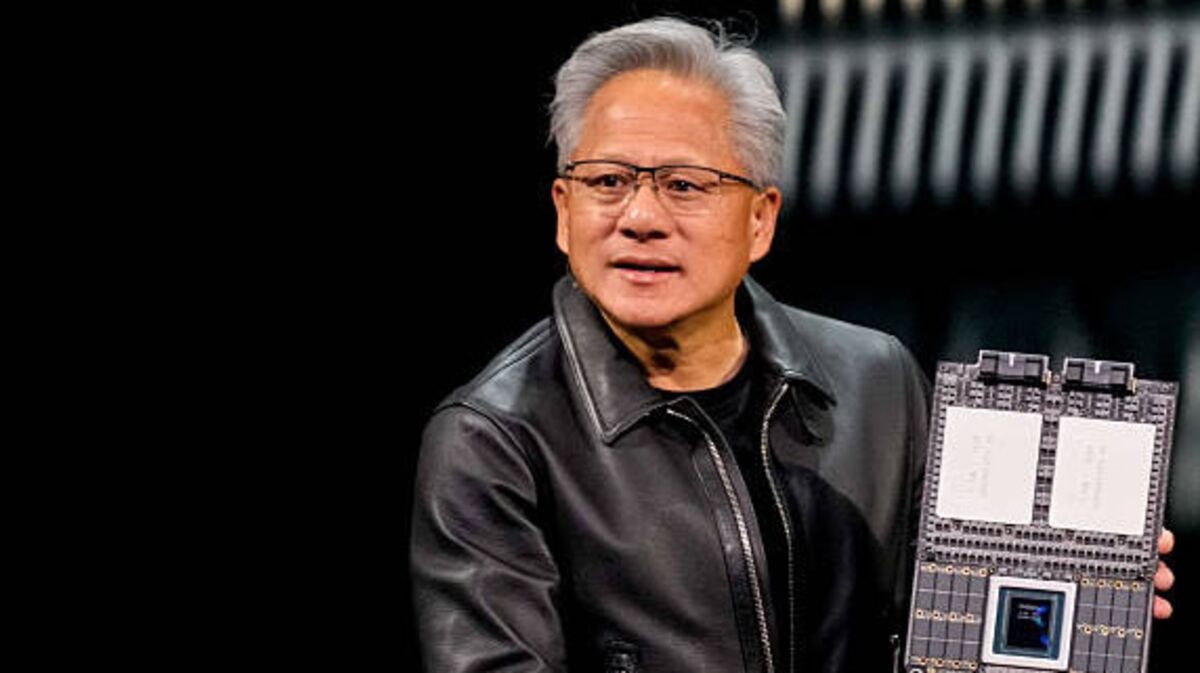

Nvidia has made a significant leap in technology with the unveiling of a new interconnect that seamlessly links quantum processors with its AI supercomputers. This innovation promises to enhance the capabilities of both technologies, potentially revolutionizing fields that rely on advanced computing. By merging AI with quantum computing, Nvidia is positioning itself at the forefront of the tech industry, paving the way for breakthroughs that could impact various sectors, from healthcare to finance.

— Curated by the World Pulse Now AI Editorial System